Outsurance’s Buildings vs. Contents Insurance – Which One Do You Need?

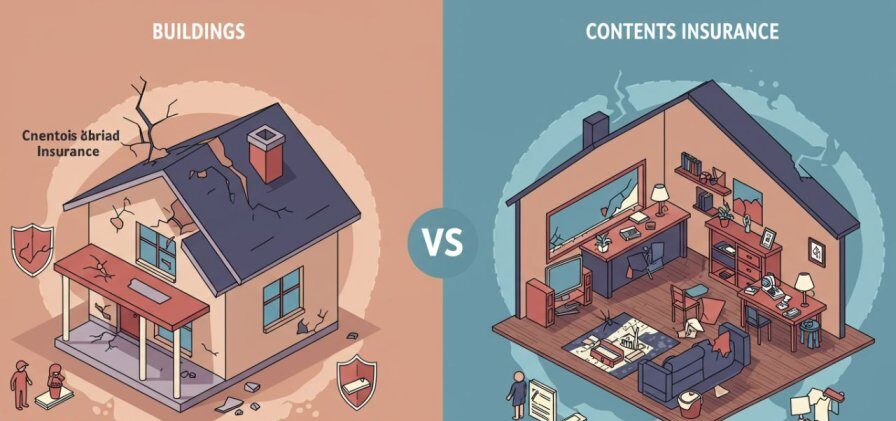

Let’s have a look something that can be a bit of a hustle to figure out, but it’s super important, especially when it comes to keeping your home safe and sound: Buildings vs. Contents insurance with Outsurance. You know, that feeling when you’re trying to figure out if your braai (barbecue) tools are covered if a tornado hits, but also whether the actual roof of your house is too? It’s like trying to tell the difference between pap (porridge) and samp, (crushed corn kernels) similar, but definitely not the same!

Many of us homeowners and renters get a bit muddled (confused) about what’s what. So, if your house burns down, will Outsurance replace your brand-new flat-screen TV? What about the roof that’s now just a memory? Don’t stress, boet (brother)! Let’s break it down properly so you can sleep easy, knowing your castle (home) and all your cool stuff are covered.

What is Buildings Insurance? (Covering the Bricks and Mortar)

Alright, picture this: Buildings insurance is like the foundation of your home’s protection. It’s all about the physical structure of your place, the walls, the roof, the floors, the stuff that’s bolted down and isn’t going anywhere. Think of it as protecting the shell of your house, not what’s inside it.

So, what’s usually included?

- Damage from the elements: If a massive hailstorm (like the ones we sometimes get, where the ice looks like golf balls!) smashes your roof tiles, or a burst geyser (water heater) turns your ceiling into a waterfall, buildings insurance usually covers that. Fire damage, crazy storms, even earthquakes, that’s all in this pot.

- Permanent fittings: This includes things like your kitchen counters, built-in cupboards, bathroom fittings, and yes, your geyser. If you picked up the house and turned it upside down, anything that doesn’t fall out is probably part of the building.

Who needs this kind of cover?

- Homeowners: If you own your home, especially if you have a bond (home loan) with the bank, you absolutely need this. The banks insist on it because they want to protect their investment, which is your house! It’s not an option, it’s a must.

- Example Scenario: Themba just bought his first house in Durban North, and it’s bonded. A massive storm rips through, and a tree falls on his roof, damaging a wall. Luckily, his Outsurance Buildings insurance will help him fix the roof and wall, saving him from a massive bill. The bank would have insisted he has this in place, anyway.

- Landlords: If you own a property and rent it out, you’re the one responsible for the building. So, you’ll need Buildings insurance to protect your investment from any structural damage.

What is Contents Insurance? (Covering Your Personal Stash)

Now, contents insurance is a whole different kettle of fish (matter)! This cover is all about your movable items, all the cool stuff that makes your house a home. If you picked up your house and turned it upside down, everything that falls out is what contents insurance is for!

What’s typically covered here?

- Your everyday goodies: We’re talking about your fancy flat-screen TV, that comfy couch you binge-watch shows on, your clothes, your beloved PlayStation, the fridge, your granny’s old antique cabinet, you get the picture.

- Theft or accidental damage: If some skelms (criminals) break in and swipe (steal) your electronics, or if you accidentally drop your new smartphone and crack the screen (oops!), this is where contents insurance steps in.

Who needs to consider contents cover?

- Renters: If you’re renting a flat or a house, you don’t own the building, so you don’t need Buildings insurance. But all your personal belongings inside are your responsibility. Imagine losing all your furniture and clothes in a fire, that’s a real moerse (huge) financial knock!

- Example Scenario: Sipho rents a cool bachelor pad (studio apartment) in Umhlanga. He has a brand-new sound system and a designer couch. One night, his flat gets broken into, and his sound system is gone. His landlord’s insurance won’t cover his stuff, but because Sipho has Outsurance Contents insurance, he can replace his stolen goods.

- Homeowners: Even if you own your home and have Buildings insurance, you still need Contents insurance! Your house might be rebuilt after a fire, but what about all your clothes, furniture, and gadgets? They won’t magically reappear!

Key Differences at a Glance: Easy Peasy, Lemon Squeezy!

Let’s put it side-by-side, just to make it super clear, like telling the difference between a bunny chow (curry in bread) and a Gatsby (large sandwich) – both delicious, but distinct!

| Feature | Buildings Insurance | Contents Insurance |

| Covers | Structure (bricks, roof, walls) | Belongings (TVs, furniture, clothes) |

| Required by Banks? | Yes (for bonded homes) | No |

| Tenants Need It? | No (landlord’s responsibility) | Yes (their own items) |

So, Do You Need Both? The Million Rand Question!

Okay, let’s cut to the chase:

- If you’re a Homeowner: Most likely, yes, you need both! Unless you’re living in an empty shell with no furniture (which would be a bit plain), your personal belongings are valuable. You protect the house with Buildings insurance and your treasured possessions with Contents insurance.

- If you’re a Renter: You definitely only need Contents insurance. The landlord is responsible for the building itself. Don’t waste your moolah (money) paying for something that’s not your responsibility!

- If you’re a Landlord: You’ll only need Buildings insurance for the property you own. Your tenants are responsible for their own stuff inside.

Outsurance’s Unique Offerings: What Makes Them Lekker (Nice)?

Outsurance, true to their out-and-out (completely) style, has some cool features for both types of cover:

- Buildings Insurance Perks:

- They focus on rebuilding costs, not just the market value of your home. This is a big deal! Rebuilding a house can often cost way more than what it’s worth on the open market, especially with fluctuating material prices. They want to make sure you can actually rebuild your home properly if disaster strikes.

- They often have optional add-ons, like specific geyser cover. Because let’s be honest, burst geysers are as common in SA as a Saturday braai, (barbecue) and they can cause a kak (bad) mess!

- Contents Insurance Perks:

- New-for-old replacement: This is a fantastic feature! If your five-year-old TV gets stolen, Outsurance will replace it with a brand new one of similar specs, not just give you what your old TV was worth after depreciation (wear and tear). No stress about trying to find a second-hand replacement!

- All-risk extensions: Got some bling (jewelry), a fancy camera, or a laptop that you carry around like a loyal pet? You can add these specific, high-value items to an “all-risk” extension on your contents policy. This means they’re covered even when they’re outside your home, whether you’re at the beach, at work, or chilling (relaxing) with friends.

Common Mistakes to Avoid:

You don’t want to be caught with your trousers around your ankles (unprepared) when something goes wrong! Here are some classic mistakes:

- Underinsuring: This is a big one!

- Buildings: People often insure their house for what they bought it for, or what the bank values it at. But rebuilding costs can be much higher due to labour and material expenses. Imagine your house is worth R1 million, but to rebuild it, it actually costs R1.5 million. If you only insured it for R1 million, you’re R500,000 short! Use Outsurance’s tools to get a realistic rebuild cost.

- Contents: It’s easy to just guess, “Ag, my stuff is probably worth R100,000.” But when you actually add up your furniture, appliances, clothes, gadgets, and even your kitchen pots and pans, that number can skyrocket! Go room by room and list everything. You’ll be surprised. Don’t forget those high-value items like your fancy bicycle, power tools, or even your surfboard!

- Overlap: If you’re renting, sometimes your landlord might have a policy that covers certain fixtures (like the oven or built-in stove). Double-check your landlord’s policy to make sure you’re not paying for something that’s already covered. No need to double-dip!

How to Choose the Right Cover: Be a Smart Cookie!

Being proactive is key!

- For Homeowners:

- Calculate rebuild costs: Outsurance often has online calculators for this, or you can get a professional estimate. This is crucial for your Buildings insurance.

- Inventory time! For contents, grab a notebook or your phone, and walk through every room. Open cupboards, check under beds. List everything and estimate its replacement cost. Take photos or videos, it helps if you ever need to claim. Think “what would it cost to buy this brand new, right now?”

- For Renters:

- Focus on contents only: Don’t even worry about Buildings insurance. Your landlord has that sorted.

- Consider all-risk: If you carry your laptop, phone, or any valuable jewelry with you often, make sure they are specified under an all-risk extension. It’s like having a little bodyguard for your precious items, even when they’re on an adventure with you!

Quick-Fire Questions (FAQ): For the Curious Minds

- “Does contents insurance cover my laptop outside the home?” Not automatically, no. It generally covers it inside your home. For cover when it’s out and about with you, you’ll need to add it specifically as an all-risk item to your policy.

- “What if I work from home? Are my office items covered?” Yes, usually your general office items (like your desk, chair, computer) would fall under contents. But if you have very specialized or high-value business equipment, or if you run a business from home, you might need to check with Outsurance about specific policy limits or a separate business policy. Better safe than sorry!

- “Can I adjust my cover mid-policy?” Absolutely! Life changes, right? You buy a new TV, sell some old furniture, or maybe get some awesome new gadgets. Just give Outsurance a shout and they can adjust your cover. Keep in mind that changes might affect your monthly premiums – either up or down, depending on what you’re doing.

Closing It Up!

So, the lowdown on Outsurance’s Buildings vs. Contents insurance! It’s clear as day (very clear) now, isn’t it? Homeowners, you’re generally looking at needing both to keep your whole property safe. Renters, you just need to worry about covering your cool stuff inside your rental place.

Just a little heads-up, though: this whole article is just to give you some info, like a friendly neighbour sharing tips. It’s not financial advice, so don’t take it as gospel (absolute truth) for your specific situation, hey? Always best to chat with a proper financial advisor or Outsurance directly to get the real deal for your unique needs.

Don’t leave yourself exposed like a fish out of water! Use Outsurance’s online calculator to estimate your needs, or better yet, give them a call. Get that personalised quote and get your home and belongings sorted! You’ll thank yourself later, I promise!

Need a car insurance? read our review on OUTsurance car insurance